Since they were introduced in 2008 cryptocurrency has become a worldwide phenomenon. Cryptocurrency or crypto is a collection of binary data that work as a tool of exchange and along with this an individual coin ownership records are kept in a ledger that keeps accounts of all transactions done. Their existence was often put under skepticism and caution but nowadays as the digital world grows more and more cryptocurrency is seen as a quite effective financial tool. But it seems to be a digital coin with two sides.

Why cryptocurrencies are so popular at scammers?

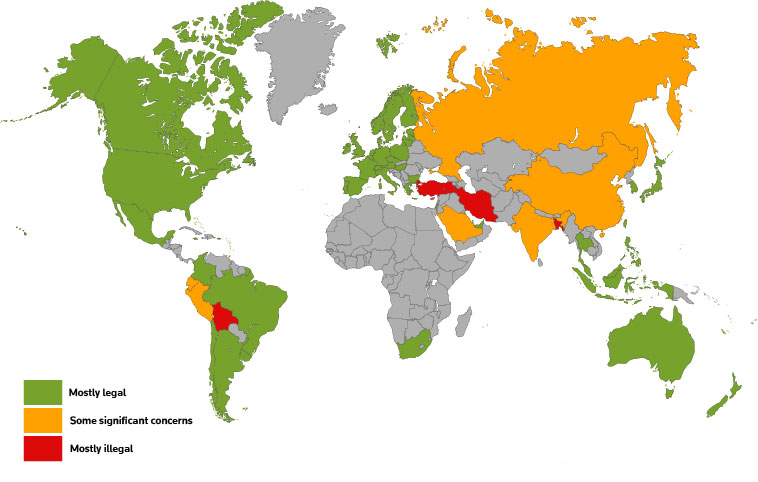

When the new phenomenon establishes itself in reality the rules to regulate it are needed. In an overview of the regulatory landscape for cryptocurrencies, Thomson Reuters listed 60 jurisdictions that apply certain rules and regulations to the crypto market. Rules and regulations that cover this market differ from a complete ban to open advocatism for that. Nevertheless, cryptocurrency is decisively making its way in every possible economy with those jurisdictions just trying to keep pace with the growth of digital money.

Recently Gazeta.Ru, a Russian news publisher, released a report with information on the most affected by crypto scammers countries. According to the published research, every tenth cryptocurrency scam occurs in Russia (10% of all detected cases), followed by Peru (6.8% of the total), and the third place is by the United States (5.3%).

With the Central Bank`s plans to develop a digital central bank currency, the Digital Ruble, in 2020 Russian President Vladimir Putin signed a law that regulates digital financial asset transactions. The law which will take effect on January 1, 2021, states that digital cryptocurrencies are accepted as a payment means and investment. Although the cryptocurrency cannot be used to pay for goods or services. Previously, digital currencies were banned.

In Peru there is no specific legislation concerning cryptocurrency. According to Peruvian Central Reserve Bank, these financial assets are not legal tender, nor are they supported by central banks, in this way they fail to meet the functions of money as a store of value, tool of exchange, and unit of account.

How do fraudsters act?

Being home to the largest number of exchanges, crypto mining firms, investment funds, and crypto investors, the United States has some inconsistencies in regulation under supervision of different agencies though.

Out of many ways the crypto scammers operate, the most common ones include creating high-quality fake celebrity pages on social networks (for phishing), asking new investors to make deposits, or spend a large amount of cryptocurrency, persuading people to share their credentials. Scammers also use special software which hijacks devices in order to secretly mine coins or steal them directly. Crypto-themed forums, free streaming portals, sites with adult content, and torrent sites are usual places for cryptocurrency-related malware.